Basic Information

Table of Contents

- 1. General remarks

- 2. Classification & Numbering

- 3. Technical data and explanations

- 4. Time-related terms for eqipment use and evaluation

- 5. Mean original value & producer price index

- 6. Cost accounting depreciation & computed interest

- 7. Repair and repair costs

- 8. Equipment providing costs

- 9. Overall equipment costs, equipment rental

- 10. Current value of construction equipment

- 11. Classification, interpolation and evaluation

- 12. CONSTRUCTION EQUIPMENT REGISTER and EDP

1. General remarks

1.1 Contents and application

IThe construction equipment register (BGL 2015) contains a listing of the current types of construction machines and construction equipment (referred to briefly as "equipment") required for the performance of construction work and for the installation of construction sites.

The Construction Equipment Register does not include construction site equipment and tools. For systematic details in this respect, the reader is referred to the "Baustellenausstattungs- und Werkzeugliste" BAL (Bauverlag, Gütersloh, 2001).

The Construction Equipment Register does not mention brand names and type designations. The individual items contain a description of the technical and economic average values supplemented by technical explanations regarding the construction and the equipment as well as the operational use of the item.

The construction machinery and equipment listed complies with the requirements of current laws, decrees and regulations regarding safety and health at the place of work.

For selected equipment types, the BGL 2015 provides information on wear parts which is intended as a guideline for the proper distinction between repair costs and other necessary expenses within the scope of the overall equipment costs in conjunction with the replacement of wear parts for which the costs are not included in the repair cost rates. The complete catalogue of wear parts for the BGL 2015 is issued by the publishers as a separate product (Bauverlag, Gütersloh; ISBN 978-3-7625-3673-4).

The present BGL 2015 has been revised with regard to the contents and the media used by retaining at the same time its structure already harmonized (EUROLISTE) on the European level and by taking into account the technical progress, new and updated regulatory codes and changes in the European economic environment. Where useful and necessary, new types of equipment and contents have been added and corresponding changes made.

The Construction equipment register is used especially for the following purposes:

- as a basis for in-house accounting and intra-company calculation of construction equipment provision costs, e.g. between the machine management department and the construction site or between joint ventures and their individual partners

- as a basis for the organization and management of equipment in building companies;

- as an aid for the evaluation of equipment and machinery costs, especially in profitability comparisons;

- as an aid for the planning of operations and progress scheduling with regard to the selection and assessment of machinery and equipment conditions of use;

- as an aid for investment planning, preparation of balance sheets and tax assessment;

- as an evaluation aid in insurance cases, expert's reports and in court decisions.

The mean original values listed in the book are based on the price basis 2014. The reference to the statistical base year valid at the time of publication of BGL 2015 will be ensured by means of the producer price index for construction machinery 2010 (see section 5.2).

With the 2015 editions, the data of the Construction equipment register BGL and those of the Austrian construction equipment register ÖBGL are practically identical. The only differences in contents existing are due to country-specific variations (e.g. laws and standards).

The BGL 2015 is available in the usual print version (book) as well as online under network licences and as a CSV file. Additional features (e.g. search functions, computation tools) will be at the user's disposal at the BGL internet portal (www.bgl-online.info).

Data in the online version will be permanently updated by the incorporation of new machines and equipment.

1.2 Supplementary remarks to the present version and to the EUROLISTE

The core data of BGL 2015 are at the same time also the master data of the EUROLISTE and thus the basis for a Europe-wide database permitting to generate in future also further country-specific versions and offers by taking national particularities into account. The further development of an integrated European all-in-one solution will facilitate the exchange of data to a considerable extent and thus contribute to enhancing the coherence of project-related workflows between construction partners. This is especially true for contacts with building partners of foreign countries and in transnational joint ventures where a more efficient and hence more economical collaboration in the field of construction machinery and equipment management can be expected.

2. Classification & Numbering

2.1 Equipment code

The BGL 2015 is divided into 24 equipment main groups with each group being designated by a single letter of the alphabet. .

The main groups are further subdivided into equipment groups, equipment subgroups and equipment types each marked by a single additional figure.

Identical equipment types are characterized by the same design and range of application. Cross-referencing is used if a piece of equipment is listed in more than one group.

In order to describe the equipment size within the equipment type for the purpose of obtaining a distinct classification, the data of one or possibly two technical parameters are used and indicated with 4 additional digits (see section 3.2).Example:

| C | EQUIPMENT MAIN GROUP | hoisting and lifting equipment |

| C.0 | EQUIPMENTMAIN GROUP | tower cranes |

| C.0.1 | EQUIPMENTSUBGROUP | tower crane, top-slewing, stationary or mobile |

| C.0.10 | EQUIPMENTTYPE (EDP term) |

tower crane with trolley beam (TURMKRAN LAUFKATZ) |

| C.0.10.0050 | EQUIPMENT SIZE | tower crane with trolley beam and nominal load moment of 50 tm |

If no technical parameters can be specified for classification purposes, the consecutive numbering for the respective equipment size will start with "0001".

For equipment types to be classified in acc. with the Construction equipment register on the basis of their original value( section 5 und section 11), he database will contain further technical parameters (years of useful life, equipment providing months, monthly depreciation and interest and monthly repair costs) of the equipment type for individual classification.

As the EUROLISTE, the Construction Equipment Register, too, does not make use of the letters "I" and "O" in order to avoid confusions. The equipment main groups "N" and "Z" are currently not employed.

2.2 Equipment options

Equipment options supplementing the standard equipment are permanently installed and usually not interchangeable pieces of equipment of a machine. They are listed after the corresponding table and designated by two letters (e.g. in the equipment code (e.g. EQUIPMENT OPTION C.0.10.0080-AA to-AU).

Equipment alternatives (e.g. electric motor instead of diesel engine) are treated as equipment options.

Equipment options will generally lead to a value increase or a value reduction with respect to the standard equipment.

Example:

Machine with equipment options (deviating from the standard equipment):

| C.0.10.0080-AA | Tower crane with trolley beam, nominal load moment of 80 tm and adjusting/hoisting gear with 1.15 to 1.4-fold motor output |

2.3 Attachments

Attachments, e.g. add-on units or boom extensions which are not permanently and firmly attached to the basic machine are treated as independent devices and designated by two figures (e.g. ATTACHMENT C.0.10.0080-00). Together with the indication of the respective equipment size and the technical parameter an independent attachment is thus clearly defined and identified.

Example:

Attachment for a basic machine (equipment size of an equipment type):

| C.0.10.****-01 | Radio remote control |

With a 10-digit code, all construction machines and equipment, equipment options and attachments of the Construction Equipment Register, including the pertaining technical data, mean original values, periods of depreciation (years of useful life) and provision costs are thus clearly identified.

3. Technical data and explanations

3.1 General

In so far as necessary, the explanations of the equipment types include technical details and provide information as to the fields of application. The definition refers to the standard version of the respective equipment types on which the values set out in the tables for each equipment size are based.

For each equipment type as defined by the first 4 digits of the code, the technical characteristics which are necessary for the evaluation of this equipment type are listed in the so-called table header.

The respective technical parameter is of special importance ( section 3.2). The technical data of a device described by 8 digits of the code under an equipment type identify this device according to size, performance and application.

3.2 Technical parameter

The technical parameter responsible for the identification according to size and thus to value is considered as the classification relevant technical parameter which is always indicated in the first column of the table containing the technical data and printed in bold type in the table header.

Each technical parameter is indicated together with the usual technical unit of measurement and thus arranged in ascending order in the respective data tables. As only a maximum of 4 digits can be used for the technical parameter in the equipment code, it is often indispensable to use tens or hundreds of the usual units or likekwise one tenth or one hundredth as the case may be.

Example:

D.8.30 Tandem vibration roller

D.8.30.0100 = max. weight in operation 1.000 kg

D.8.30.1200 = max. weight in operation 12.000 kg

Some equipment types require two technical parameters for proper classification. In these cases, both parameters are printed in bold type in the text. In the case of two parameters, the first parameter is represented by the first figure(s) while the second parameter is represented by the last figure(s).

The special conditions for the interpolation of devices to be classified between two equipment sizes in the tables are explained in section 11.2 .

Example:

| A.5.11 | Conveyor belt, portable, parameter: belt width (mm) and axle spacing (m) |

| A.5.11.0504 | Conveyor belt, portable, with a belt width of 500 mm and a distance between axles of 4 m |

| A.5.11.0506 | Conveyor belt, portable, with a belt width of 500 mm and a distance between axles of 6 m |

In other exceptional cases where technical parameters cannot ensure a meaningful classification, the technical parameter will be replaced by a consecutive numbering system.

In all exceptional cases a computer-assisted classification is not possible as any interpolation effort would lead to incorrect results.

3.3 Weights

The weights indicated are average values and serve the purpose of evaluating the costs for transport and loading. They are always related to the construction weights (without ballast, consumables and operator).

3.4 Engine power rating and consumption of consumables

The technical parameter for prime movers is the engine power rating expressed in kilowatts [kW].

3.4.1 Internal combustion engines

The specific fuel consumption of diesel engines varies with load, speed, operating condition and state of wear. Of practical importance for operations in conjunction with construction work is the fuel consumption specified by the manufacturer in kg per operating hour [kg/h] for a defined operating condition. The factor used for the litre-to-kilogram conversion of diesel fuel at average temperature is 0.84 [kg/l] (0.82 – 0.845 kg/l according to EN ISO 3675).

Taking operation-specific interruptions into account, the fuel consumption of construction machines can generally be assumed to be between 80 and 170 [g/kWh], whereas the costs for lubricant consumption are generally in the order of 10 to 12 % of the fuel costs.

3.4.2 Electric motors

For electric motors, the motor rating [kW] as indicated on the manufacturer's rating plate is to be used.

3.5 Units of measurement

The units of measurement used for technical parameters and data are based on the international SI system in ISO resp. IEC 80000 in accordance with DIN 1304. Deviations from this principle for reasons of practicability and ease of understanding will only be made in a few justified cases.

3.6 Bucket and skip capacities

The bucket and skip capacities for earth-moving machines and equipment are governed by the following standards:

- ISO 7451: Earth-moving machinery, nominal volumetric capacity of hoe-type buckets

- ISO 7546: Loaders and excavators, nominal capacity of grab-type buckets

- ISO 6483: Dumper body volumetric rating for dump vehicles

- ISO 6484: Elevating scrapers, volumetric rating

- ISO 6485: Tractor scrapers, volumetric rating

The volumetric ratings of other equipment are defined in the corresponding ISO standards.

3.7 Rounding rules for financial data

For the complete Construction equipment register the following rounding rules (Euro amounts) shall be applied:

| until | < | 0,50 € | to | 0,01 € | |||

| from | ≥ | 0,50 € | until | < | 1,00 € | to | 0,05 € |

| from | ≥ | 1,00€ | until | < | 10,00 € | to | 0,10 € |

| from | ≥ | 10,00€ | until | < | 100,00 € | to | 0,50 € |

| from | ≥ | 100,00€ | until | < | 500,00 € | to | 1,00 € |

| from | ≥ | 500,00€ | until | < | 1.000,00 € | to | 5,00 € |

| from | ≥ | 1.000,00€ | until | < | 5.000,00 € | to | 10,00 € |

| from | ≥ | 5.000,00€ | until | < | 10.000,00 € | to | 50,00 € |

| from | ≥ | 10.000,00€ | until | < | 100.000,00 € | to | 100,00 € |

| from | ≥ | 100.000,00€ | until | < | 1.000.000,00 € | to | 500,00 € |

| from | ≥ | 1.000.000,00€ | to | 1000,00 € |

4. Time-related terms for equipment use and evaluaioon

4.1 Useful life

Useful life means the average period of time during which a device can be used – according to experience – in single-shift operation under medium load conditions with economical and technical success.

Among other factors, the useful life of a device is influenced by:

- technical obsolescence

- wear

- maintenance and care

- repairs

- climatic conditions

- legal requirements (e.g. safety and environment)

- conditions of use

In the Construction Equipment Register, the useful life spans are expressed in years of use and in equipment providing months.

4.1.1 Years of use

At the time of publication of the BGL 2015, the years of use are mainly based on the useful life spans defined in the official fiscal depreciation tables for the building sector, dated December 6, 2001 (in the BGL 2015 abbreviated as "Bau-AfA"), as well as in the official depreciation tables for generally usable investment goods dated December 15, 2000 (in the BGL 2015 abbreviated as "allg. AfA"), in so far as they contain additionally construction-related equipment.

The useful life spans indicated in the aforementioned depreciation tables serve as a guideline for the tax deductibility of goods acquired after December 31, 2000. If construction equipment listed in the BGL 2015 can be identified as belonging to a concrete source reference in these depreciation tables, this reference is mentioned accordingly. In other cases, the years of useful life stated in the construction equipment register are based on experience gained in many years of construction work and/or derived from comparable construction machinery.

4.1.2 Actual average duration of use (providing months)

Experience has shown that construction equipment cannot be used without interruption during their total useful life span. For the purpose of determining the actual average duration of use the periods during which the equipment is not used for operational and other reasons must therefore be deducted from the useful life span. This duration of use is expressed in the form of providing months.

These equipment providing months are empirical values for actually achieved total periods of economical utilization as determined during many years of experience in building projects. They are indicated in the construction equipment register as "from…to" values in order to account also for individual cases which deviate from typical average values.

The equipment providing months are valid for medium-duty loading and single-shift work of the equipment and on condition that the equipment is properly maintained and cared for and that repairs are carried out whenever necessary. The equipment providing months are the basis for cost-accounting depreciation as well as one of the important factors for the determination of the computed interest ( section 6).4.2 Total lifetime

Total lifetime is to be understood as the time span between the production (year of construction) and the definite withdrawal (scrapping) of a device. This time span must not be identical with the useful life span.

4.3 Providing period

The providing period is the time span during which a device is held at the disposal of a specific construction site and cannot be used for other purposes.

| Start: | Date of dispatch to place of use. |

| End: | Date of dispatch to the new place of use or to the storage yard or the effective date of reavailability. If the device is transported back to the storage yard, the providing period may, if applicable, also com-prise the times for loading and return transport. |

In the case of oversize equipment which must be dismantled for transport, this provision applies accordingly to the dispatch of the first partial consignment, respectively to the last partial consignment in the case of return transport.

The providing period comprises:

- time for transport to and back from the place of use (see above)

- set-up and take-down times

- times for retrofitting

- times of operation

- construction site-induced waiting times

- distribution time and time losses

- times of transfer on the construction site

- downtimes due to force majeure or similar events ( section 4.4)

- times for maintenance and care

- repair periods in so far as the site is responsible for maintaining the equipment in a ready-for-operation state (generally repairs at the place of use.)

- repair periods due to damage caused by force

4.4 Downtimes

Downtimes are time spans within the providing period forcing the device user to immobilize a device for reasons of force majeure or similar circumstances beyond the user‘s control. The accounting of downtimes is explained in section 8.4.

4.5 Repair periods

Repair periods are periods intended for the preparation and the execution of repair work on the equipment (on a construction site or in a repair shop) for the purpose of maintaining or restoring the machine's suitability for use. The repair period includes also inevitable waiting times for spare parts.

5. Mean original value & producer price index

5.1 Mean original value and original value

The mean original values indicated in the BGL 2015 are mean values of the list prices in EURO (€) for the most common brands with price basis 2014 including the costs of acquisition. The costs of acquisition include freight rates, packing and customs duties.

The mean original values are valid for completely equipped machines ready for operation, but without spare parts and without fuel.

The mean original values include the technical requirements applicable on the date of acquisition. In the case of technical equipment which serves the purpose of fulfilling the current requirements, the mean original values must be adapted accordingly (upgrade).

For mobile construction equipment the mean original values includes also the respective standard tires. In the case of tires other than the standard tires (e.g. rock tires for wheel loaders), the mean original value must be adapted in each individual case on the basis of the original value of the tires (see section 11.5).If it is not possible to indicate a practicable mean original value for an equipment type – e.g. due to the lack of sufficient price quotes or because of strongly differing technical performance features or widely varying list prices – the evaluation must be based on the original value (see section 11).

The mean original values and the original values do not include the VAT.

5.2 Producer price index

Experience has shown that the acquisition costs of devices do not remain constant over time. It is therefore necessary to account for the evolution of the acquisition costs and of the mean original values.

This cost evolution can be accounted for by means of the official producer price index for construction machinery as published by the Federal Statistical Office in Wiesbaden the weighting scheme of which was published at the time of publication of BGL 2015 on the basis 2010 = 100 and which is being updated monthly and for average annual values.

In order to provide the construction industry with the most current data available, the BGL 2015 indicates the mean original values with reference to the price basis 2014. Therefore, the official producer price index for machines in the construction industry 2010 = 100 was changed by the Hauptverband der Deutschen Bauindustrie e. V. [Federation of the German Construction Industry (see table 1) to represent the new basis.

Table 1:

Producer price index for construction machinery and equipment without VAT;

Producer price index ix 2014 = 100, referred to price basis BGL 2015

| Reference year | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| 2014 = 100 | 100,0 | 98,6 | 97,0 | 94,2 | ||||||

| Reference year | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

| 2014 = 100 | 92,8 | 91,9 | 89,1 | 86,8 | 85,6 | 84,5 | 82,5 | 81,5 | 81,7 | 81,0 |

| Reference year | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 |

| 2014 = 100 | 80,2 | 79,9 | 78,9 | 78,8 | 78,9 | 78,1 | 77,0 | 76,6 | 74,4 | 72,0 |

| Reference year | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 | 1984 | 1983 | 1982 | 1981 |

| 2014 = 100 | 69,6 | 67,2 | 64,9 | 63,8 | 62,4 | 60,9 | 59,2 | 58,0 | 56,3 | 53,7 |

| Reference year | 1980 | 1979 | 1978 | 1977 | 1976 | 1975 | 1974 | 1973 | 1972 | 1971 |

| 2014 = 100 | 51,9 | 49,7 | 48,6 | 47,4 | 45,5 | 43,7 | 40,7 | 38,0 | 36,5 | 35,2 |

Source: Federal Statistical Office, Wiesbaden, basis modified by Hauptverband der Deutschen Bauindustrie e.V..

Info: In August 2013, the official producer price index was changed by the Federal Statistical Office to a new weighting scheme and basis year 2010 = 100. The corresponding values are shown in table 2.

Table 2:

Official producer price index for machinery in the construction industry without value-added tax;

producer price index i 2010 = 100

| Reference year | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| 2010=100 | 86,5 | 87,3 | 88,1 | 87,9 | 88,9 | 91,1 | 92,3 | 93,6 | 96,0 | 99,1 | 100,0 | 101,6 | 104,6 | 106,3 | 107,8 |

Source: Federal Statistical Office, Wiesbaden

To establish, if necessary, a relationship with construction equipment register 2007, the following table 3 lists the hitherto valid data up to the year 2014 (price basis: year 2000 = 100).

Table 3:

Producer price indices 2000 = 100 for machinery in the construction industry without value-added tax, BGL 2007

| Reference year | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| 2000=100 | 100,0 | 100,9 | 101,8 | 101,6 | 102,7 | 105,3 | 106,7 | 108,2 | 110,9 | 114,5 | 115,5 | 117,4 | 121,3 | 122,9 | 124,6 |

Source: Hauptverband der Deutschen Bauindustrie e.V. based on data of the Federal Statistical Office, Wiesbaden

By multiplying the mean original values with producer price index ix, referred to price basis 2014, the mean original values can on average be correctly updated for a machine pool and replacement costs thus be determined.

Ax=A*ix / 100 (1)

| Ax | mean original value for replacement in the year x |

| A | mean original value of the CONSTRUCTION EQUIPMENT REGISTER 2015 (mean original value on basis 2014) |

| Ix | producer price index for construction machinery in the year x, referred to 2014 = 100 = A * i / 100 (1) (see table 1) |

The average annual values are published regularly by the Hauptverband der Deutschen Bauindustrie [Federation of the German Construction Industry] and by the Zentralverband des deutschen Baugewerbes [German Construction Confederation].

6. Cost accounting depreciation & computed interest

6.1 Cost-accounting depreciation

Cost-accounting depreciation is the process of determining the loss of value of the equipment and the taking into account of this loss as costs. The starting value is the mean original value indicated in the Construction Equipment Register.

For practical purposes in the construction industry, the cost-accounting depreciation is generally linear, i.e. in amounts of the same order per time unit.6.2 Computed interest

The computed interest is the fictitious interest which would be yielded by the capital tied up in the residual value of the equipment not yet written off. The BGL is based on a computed interest rate of 6.5 % p.a.

6.3 Calculation of depreciation and interest (A+V)

The percentage rates usually applied in the construction industry for depreciation purposes (a) are shown in table 4. The interest values (z) and the usual A+V rates (k) are shown in table 5.

For the individual equipment types, the monthly percentage rates for depreciation and interest are listed together with the other economic key data (years of useful life, providing months and repair cost rates). These values apply also to the equipment types listed below in so far as no different key data have been provided for these types.

The monthly rates and amounts for depreciation and interest determined from the mean original value in the Construction Equipment Register are based on the following elements:

- mean original value

- linear depreciation

- simple interest calculation

- computed interest rate p = 6.5 % per annum

- time unit = 1 providing month

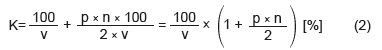

The monthly rates for depreciation and interest as a percentage of the mean original value result from the following equation:

| K | monthly rate of depreciation and interest in percent of the mean original value |

| v | providing month |

| n | years of use |

| p | computed interest rate of 6.5 % = 0.065 |

|

rate of monthly depreciation as a percentage of the mean original value (see table 4) |

|

average rate of interest per month as a percentage of the mean original value (see table 5) |

| p * n * 100 / 2 | total rate of interest |

| k = a + z [%] | all values of k usually encountered in the construction industry are indicated in table 5 |

The monthly rates of depreciation and interest indicated in the Construction Equipment Register are calculated as follows:

K = k * A [€/month] (3)

| K | monthly rate of depreciation and interest [€] |

| A | mean original value [€] |

Table 4:

Monthly rates of depreciation a as a percentage of the mean original value depending on the number of the

equipment providing months v

| v [months] | 15 | 20 | 25 | 30 | 35 | 40 | 45 | 50 | 55 | 60 | 65 | 70 | 75 | 80 | 85 | 90 | 100 | 110 | 120 | 130 | 140 | 150 | 160 |

| a [%] | 6,67 | 5,00 | 4,00 | 3,33 | 2,86 | 2,50 | 2,22 | 2,00 | 1,82 | 1,67 | 1,54 | 1,43 | 1,33 | 1,25 | 1,18 | 1,11 | 1,00 |

0,91 | 0,83 | 0,77 | 0,71 | 0,67 | 0,63 |

Table 5:

Monthly rates of depreciation and interest k Total rates of interest and monthly rates of interest z as a percentage of the original value

| years of use |

total interes rates |

Monthly rates z and k as a percentage of the original value and equipment providing months v of: | |||||||||||||||||||||||

| 15 | 20 | 25 | 30 | 35 | 40 | 45 | 50 | 55 | 60 | 65 | 70 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| n | % | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k |

| 3 | 9,75 | 0,65 | 7,3 | 0,49 | 5,5 | 0,39 | 4,4 | 0,33 | 3,7 | 0,28 | 3.1 | ||||||||||||||

| 4 | 13 | 0,87 | 7,5 | 0,65 | 5,7 | 0,52 | 4,5 | 0,43 | 3,8 | 0,37 | 3,2 | 0,33 | 2,8 | 0,29 | 2,5 | ||||||||||

| 5 | 16,25 | 1,08 | 7,8 | 0,81 | 5,8 | 0,65 | 4,7 | 0,54 | 3,9 | 0,46 | 3,3 | 0,41 | 2,9 | 0,36 | 2,6 | 0,33 | 2,3 | 0,3 | 2,1 | 0,27 | 1,9 | ||||

| 6 | 19,5 | 0,98 | 6,0 | 0,78 | 4,8 | 0,65 | 4,0 | 0,56 | 3,4 | 0,49 | 3,0 | 0,43 | 2,7 | 0,39 | 2,4 | 0,35 | 2,2 | 0,33 | 2,0 | 0,30 | 1,8 | ||||

| 7 | 22,75 | 1,14 | 6,1 | 0,91 | 4,9 | 0,76 | 4,1 | 0,65 | 3,5 | 0,57 | 3,1 | 0,51 | 2,7 | 0,46 | 2,5 | 0,41 | 2,2 | 0,38 | 2,0 | 0,35 | 1,9 | 0,33 | 1,8 | ||

| 8 | 26 | 1,30 | 6,3 | 1,04 | 5,0 | 0,87 | 4,2 | 0,74 | 3,6 | 0,65 | 3,2 | 0,58 | 2,8 | 0,52 | 2,5 | 0,47 | 2,3 | 0,43 | 2,1 | 0,40 | 1,9 | 0,37 | 1,8 | ||

| 9 | 29,25 | 1,46 | 6,5 | 1,17 | 5,2 | 0,98 | 4,3 | 0,84 | 3,7 | 0,73 | 3,2 | 0,65 | 2,9 | 0,59 | 2,6 | 0,53 | 2,4 | 0,49 | 2,2 | 0,45 | 2,0 | 0,42 | 1,8 | ||

| 10 | 32,5 | 1,63 | 6,6 | 1,30 | 5,3 | 1,08 | 4,4 | 0,93 | 3,8 | 0,81 | 3,3 | 0,72 | 2,9 | 0,65 | 2,7 | 0,59 | 2,4 | 0,54 | 2,2 | 0,50 | 2,0 | 0,46 | 1,9 | ||

| 11 | 35,75 | 1,79 | 6,8 | 1,43 | 5,4 | 1,19 | 4,5 | 1,02 | 3,9 | 0,89 | 3,4 | 0,79 | 3,0 | 0,72 | 2,7 | 0,65 | 2,5 | 0,60 | 2,3 | 0,55 | 2,1 | 0,51 | 1,9 | ||

| 12 | 39 | 1,95 | 7,0 | 1,56 | 5,6 | 1,30 | 4,6 | 1,11 | 4,0 | 0,98 | 3,5 | 0,87 | 3,1 | 0,78 | 2,8 | 0,71 | 2,5 | 0,65 | 2,3 | 0,60 | 2,1 | 0,56 | 2,0 | ||

| 13 | 42,25 | 2,11 | 7,1 | 1,69 | 5,7 | 1,41 | 4,7 | 1,21 | 4,1 | 1,06 | 3,6 | 0,94 | 3,2 | 0,85 | 2,8 | 0,77 | 2,6 | 0,70 | 2,4 | 0,65 | 2,2 | 0,60 | 2,0 | ||

| 14 | 45,5 | 2,28 | 7,3 | 1,82 | 5,8 | 1,52 | 4,9 | 1,30 | 4,2 | 1,14 | 3,6 | 1,01 | 3,2 | 0,91 | 2,9 | 0,83 | 2,6 | 0,76 | 2,4 | 0,70 | 2,2 | 0,65 | 2,1 | ||

| 15 | 48,75 | 2,44 | 7,4 | 1,95 | 6,0 | 1,63 | 5,0 | 1,39 | 4,3 | 1,22 | 3,7 | 1,08 | 3,3 | 0,98 | 3,0 | 0,89 | 2,7 | 0,81 | 2,5 | 0,75 | 2,3 | 0,70 | 2,1 | ||

| 16 | 52 | 1,73 | 5,1 | 1,49 | 4,3 | 1,30 | 3,8 | 1,16 | 3,4 | 1,04 | 3,0 | 0,95 | 2,8 | 0,87 | 2,5 | 0,80 | 2,3 | 0,74 | 2,2 | ||||||

| 18 | 58,5 | 1,98 | 5,3 | 1,67 | 4,5 | 1,46 | 4,0 | 1,30 | 3,5 | 1,17 | 3,2 | 1,06 | 2,9 | 0,98 | 2,6 | 0,90 | 2,4 | 0,84 | 2,3 | ||||||

| 20 | 65 | 2,17 | 5,5 | 1,86 | 4,7 | 1,63 | 4,1 | 1,44 | 3,7 | 1,30 | 3,3 | 1,18 | 3,0 | 1,08 | 2,8 | 1,00 | 2,5 | 0,93 | 2,4 | ||||||

| 21 | 68,25 | 2,28 | 5,6 | 1,95 | 4,8 | 1,71 | 4,2 | 1,52 | 3,7 | 1,37 | 3,4 | 1,24 | 3,1 | 1,14 | 2,8 | 1,05 | 2,6 | 0,98 | 2,4 | ||||||

| 25 | 81,25 | ||||||||||||||||||||||||

Table 5 (continued)

| years of use |

total interes rates |

Monthly rates z and k as a percentage of the original value and equipment providing months v of: | |||||||||||||||||||||

| 75 | 80 | 85 | 90 | 100 | 110 | 120 | 130 | 140 | 150 | 160 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| n | % | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k | z | k |

| 3 | 9,75 | ||||||||||||||||||||||

| 4 | 13 | ||||||||||||||||||||||

| 5 | 16,25 | ||||||||||||||||||||||

| 6 | 19,5 | ||||||||||||||||||||||

| 7 | 22,75 | 0,30 | 1,6 | ||||||||||||||||||||

| 8 | 26 | 0,35 | 1,7 | 0,33 | 1,6 | 0,31 | 1,5 | ||||||||||||||||

| 9 | 29,25 | 0,39 | 1,7 | 0,37 | 1,6 | 0,34 | 1,5 | 0,33 | 1,4 | 0,29 | 1,3 | ||||||||||||

| 10 | 32,5 | 0,43 | 1,8 | 0,41 | 1,7 | 0,38 | 1,6 | 0,36 | 1,5 | 0,33 | 1,3 | 0,30 | 1,2 | ||||||||||

| 11 | 35,75 | 0,48 | 1,8 | 0,45 | 1,7 | 0,42 | 1,6 | 0,40 | 1,5 | 0,36 | 1,4 | 0,33 | 1,2 | ||||||||||

| 12 | 39 | 0,52 | 1,9 | 0,49 | 1,7 | 0,46 | 1,6 | 0,43 | 1,5 | 0,39 | 1,4 | 0,35 | 1,3 | 0,33 | 1,2 | 0,30 | 1,1 | ||||||

| 13 | 42,25 | 0,56 | 1,9 | 0,53 | 1,8 | 0,50 | 1,7 | 0,47 | 1,6 | 0,42 | 1,4 | 0,38 | 1,3 | 0,35 | 1,2 | 0,33 | 1,1 | ||||||

| 14 | 45,5 | 0,61 | 1,9 | 0,57 | 1,8 | 0,54 | 1,7 | 0,51 | 1,6 | 0,46 | 1,5 | 0,41 | 1,3 | 0,38 | 1,2 | 0,35 | 1,1 | ||||||

| 15 | 48,75 | 0,65 | 2,0 | 0,61 | 1,9 | 0,57 | 1,8 | 0,54 | 1,7 | 0,49 | 1,5 | 0,44 | 1,4 | 0,41 | 1,2 | 0,38 | 1,1 | 0,35 | 1,1 | 0,33 | 1,0 | 0,30 | 0,9 |

| 16 | 52 |

0,69 | 2,0 | 0,65 | 1,9 | 0,61 | 1,8 | 0,58 | 1,7 | 0,52 | 1,5 | 0,47 | 1,4 | 0,43 | 1,3 | 0,40 | 1,2 | 0,37 | 1,1 | 0,35 | 1,0 | 0,33 | 1,0 |

| 18 | 58,5 |

0,78 | 2,1 | 0,76 | 2,0 | 0,69 | 1,9 | 0,65 | 1,8 | 0,59 | 1,6 | 0,53 | 1,4 | 0,49 | 1,3 | 0,45 | 1,2 | 0,42 | 1,1 | 0,39 | 1,1 | 0,37 | 1,0 |

| 20 | 65 |

0,87 | 2,2 | 0,81 | 2,1 | 0,76 | 1,9 | 0,72 | 1,8 | 0,65 | 1,7 | 0,59 | 1,5 | 0,54 | 1,4 | 0,50 | 1,3 | 0,46 | 1,2 | 0,43 | 1,1 | 0,41 | 1,0 |

| 21 | 68,25 | 0,91 | 2,2 | 0,85 | 2,1 | 0,80 | 2,0 | ||||||||||||||||

| 25 | 81,25 | 1,08 | 2,4 | 1,02 | 2,3 | 0,96 | 2,1 | 0,90 | 2,0 | 0,81 | 1,8 | 0,74 | 1,6 | 0,68 | 1,5 | 0,63 | 1,4 | 0,58 | 1,3 | 0,54 | 1,2 | 0,51 | 1,1 |

Since the equipment providing months v are indicated in the Construction Equipment Register as "from ...to" values, the monthly amounts of depreciation and interest resulting are "from … to" values as well.

- The following relationship applies: higher values for v correspond to the lower values for k resp. K,

-

lower values for v correspond to higher values for k resp. K

The monthly amounts of K indicated must be rounded off in acc. with the rounding rules in section 3.7.

7. Reparatur und Reparaturkosten

7.1 General

The expenditures required for maintaining or restoring the ready-for-operation state of equipment are an essential part of the overall equipment costs. As a result of the heavy-duty utilization of the equipment in construction work, frequent change of the place of use, insufficient protection against the weather throughout the seasons and changing operating and maintenance personnel the repair costs for construction equipment are markedly higher than those for comparable stationary equipment.

The repair activities necessary for maintaining and restoring a machine's operational availability are divided into:

- Maintenance

Maintenance includes the permanent repair activities necessary during the providing period in order to keep the equipment in a ready-for-operation state on the construction site. - Overhaul

Overhaul includes all repair activities outside the providing period, which are required to restore the equipment for the next deployment on a construction site to the best possible state of operation and optimum performance.

The repair costs can be roughly divided into:

- approx 30 % for maintenance

- approx. 70 % for overhaul

of the repair costs and amounts indicated in the CONSTRUCTION EQUIPMENT REGISTER.

The costs are approximately composed as follows: :

- 60% wage costs (gross wages)

- 40 % material costs(costs for repair materials and spare parts free place of repair without VAT)

Incidental wage costs as well as supplements related to hour¬ly wage rates, e.g. overheads for construction site repair shops are not included.

7.2 Repair costs

The actual repair costs generally rise with longer utilization. In spite of this fact, the Construction Equipment Register is based on the assumption of repair costs remaining constant throughout the whole service life as only the accounting of age-independent average costs is feasible in practice. For this reason, repair costs are indicated in the Construction Equipment Register as average costs over the whole service life.

All repair cost rates and amounts stated in the Construction Equipment Register are valid for medium-severe working conditions, single-shift work and appropriate maintenance and care.

The costs are calculated as follows:

R = r * A [€/month] (4)

| R | monthly amount of repair [€/month] |

| r | monthly rate for repair costs as a percentage of the mean original value |

| A | mean original value [€] |

For rounding up or rounding down, the rounding table of section 3.7 applies accordingly.

7.3 Scope of repair work and repair costs

Equipment repair in terms of the indicated rates for repair costs includes:

- the work performed at the place of use as well as in internal and in external workshops (labour costs) required for maintaining and for restoring the state of operational availability;

- the installation of spare parts, units, working equipment and other structural components (costs of material) required for maintaining and for restoring the state of operational availability.

The repair cost rates and amounts do not include:

- maintenance and care (e.g. lubrication, oil change, filter change)

- checks

- setting and adjusting work as well as the pertaining costs of material

- cleaning and removal of contaminations caused by building materials and soil

- removal of damage caused by the use of force

- exchange of such wear parts that as are listed for the respective equipment type under "wear parts" (separate accounting, see section 7.4).

7.4 Wear parts

Certain machine components are subject to increased wear even under average load conditions. The repair of these components is generally not economical so that these parts must be replaced again and again depending on their degree of wear. The replacement or the reworking of these parts (e.g. deposit welding) within the scope of repair or regular maintenance activities is not included in the repair cost rates.

The Construction Equipment Register BGL 2015 takes this into account by indicating for specific equipment sizes those typical wear parts with a generally higher than usual rate of wear.

In case of extreme conditions of use, even such structural components which are normally not classified as wear parts and which – under normal conditions of use – would be replaced in the course of regular maintenance work, may be exposed to abnormal wear. Frequent examples are the teeth of excavator buckets, cutting edges, gyros, casings of sand/water pumps, milling and hinged teeth.

A listing of the wear parts indicated in the construction equipment register is published in the form of the so-called wear parts catalogue supplement to the BGL 2015 as a separate product of the publishing house (Bauverlag, Gütersloh; ISBN 978-3-7625-3673-4).

8. Equipment providing costs

8.1 Time units for calculating the provision of equipment

The time unit applied is the month in terms of the monthly rates for depreciation and interest as well as for repair costs.

The conversion to smaller time units is based on the following rule:

1 equipment providing month = 30 calendar days = 170 providing hours (single-shift work).

If the equipment providing costs are determined as an exception on a days-of-work basis, the term '30 calendar days' will be replaced by 21 days of work = 170 providing hours (single-shift work).

8.2 Calculation of providing costs

Equipment providing costs are composed of:

- depreciation and interest (interest payments)

- repair costs

overall providing costs = providing period * providing costs / time unit

providing costs per calendar day = 1/30 of the monthly rate

providing costs per equipment providing hour = 1/170 of the monthly rate

8.3 Equipment extra hours

Equipment extra hours are the hours of utilization exceeding 170 providing hours per month or – in the case of providing periods of less than one month – the hours of utilization exceeding the corresponding proportion of hours of utilization.

The costs to be assumed for every equipment extra hour are the full costs of the normal providing hour for single-shift work. The change of the interest share due to a reduction of the duration of use can generally be neglected as the number of equipment extra hours is usually small compared to the total number of providing hours. If exceptionally necessary in case of a large number of extra hours or shift work to take a reduced interest share into account, the values fixed in table 5 can be used for this purpose.

No extra hours will be charged for the following equipment and installations: site installation (e.g. accomodation facilities, containers), electricity distribution boards for construction sites, generating sets, transformers, pipelines for air and water supply and disposal, reservoirs, fittings, scaffolds, measuring and testing equipment, cars.

8.4 Providing costs for downtimes

In case of downtimes as mentioned under section 4.4 within a providing period of more than 10 consecutive calendar days, the following costs will be considered as providing costs:

- for the first 10 calendar days the full depreciation and inter-est as well as the full repair costs;

- from the 11th calendar day onwards, 75 % of depreciation and interest and for maintenance and care 8 % of the de-preciation and interest rates, but without repair costs.

9. Overall equipment costs, equipment rental

Besides the equipment costs (see section 8) additional costs occur from equipment ownership and equipment utilization, i.e.:

- operation

- consumables and lubricants

- maintenance and care

- equipment insurance and taxes

- set-up and take-down (erection, dismantling)

- loading, transports

- checks

- storage

- work-related equipment options (e.g. GPS, anemometer), and proportional general overheads and business risks

In the case of equipment rental, it depends on the contractual arrangements whether and to which extent the rental customer takes over these costs.

10. Current value of construction equipment

The current value or value on a day or market value of a piece of equipment is the price that can be achieved when a used piece of equipment is sold.

The current value depends on the mean original value, the age and the condition of a piece of equipment.

The current value must be known when a piece of equipment is to be sold, for "sale and lease-back" agreements, for evaluations within joint ventures, for rental and insurance and in case of loss during a rental period or during construction work.

There is no relationship whatsoever between current value, cost-accounting depreciation and interest or depreciation for tax purposes.

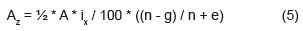

The current value Az of construction equipment is calculated as follows:

| Az | current value [ε] |

| A | mean original value [ε] |

| iy | producer price index for construction machinery in the year x of the acquisition referred to 2014 = 100 (see table 1) |

| n | useful life in years |

| g | equipment age in years |

| e | coefficient representing the technical condition |

| e = | 1.0 as good as new |

0.9 very good |

|

0.8 good |

|

0.7 satisfactory |

|

0.6 fair |

|

0.5 poor, operational only within limits |

|

0.3 poor, not operational, repair possible |

For g ≥ the following applies: (n - g) / n = 0

Referred to price basis 2014, the index ix of previous years can be used in the formula (5).

11. Classification, interpolation and evaluation

11.1 Classification

The devices must be classified in accordance with their classification-relevant technical parameter .

If a parameter is defined by a "from… to" value and if the technical parameter of the device to be classified lies inside the range bounded by these two values, then the device belongs to the corresponding equipment size (Ex. L.3.10).

If the technical parameter of a device can be found between two individual values, then the device has to be classified by means of interpolation. The number of the respective device includes the actual technical parameter.

Example:

| C.0.10 | tower crane with trolley beam |

| C.0.10.0090 | tower crane with trolley beam and 90 tm load moment |

For space-saving reasons, the possible equipment sizes for equipment options and attachments are represented by a placeholder (*). During the classification procedure, the placeholder is to be substituted by the actually valid equipment size.

Example:

| C.0.10.0080 | tower crane with trolley beam and 80 tm nominal load moment |

| C.0.1*.**** | equipment option: |

| C.0.10.0080-AD | PLC controller instead of contactor equipment for tower crane with trolley beam and 80 tm nominal load moment |

| C.0.10.0100-AD | as above, but for ... 100 tm nominal load moment |

11.2 Interpolation

If the technical parameter of a device lies between two indicated values of larger and smaller equipment sizes, the mean original value can be determined with sufficient accuracy by means of the following formula:

A = A1 + (A2 – A1) * (P – P1) / (P2 – P1) [€] (6)

| A | mean original value of the device to be evaluated |

| P | technical parameter of the device to be evaluated |

| P1 | technical parameter of the next smaller size |

| A1 | mean original value of the next smaller size |

| P2 | technical parameter of the next larger size |

| A2 | mean original value of the next larger size |

This is also valid in a similar way for equipment options and attachments.

Instead of the mean original values A1 and A2 it is also possible to use the monthly amounts for depreciation and interest K1 and K2 or the monthly amounts for repair R1 und R2 in the formula in order to obtain K or R, i.e. the amount for depreciation and interest respectively the monthly amount for repairs of the equipment to be evaluated, directly.

11.3 Special cases of classification

If two technical parameters are necessary for classifying a device, the mean original value cannot be interpolated with the help of formula (6).

In each case it is necessary to evaluate the corresponding interpolated value with regard to its plausibility.

For the classification of devices with intermediate values in the first technical parameter, the evaluation must be based on the respective original values of the device. For more detailed information see section 11.5.

11.4 Extrapolation

Extrapolation becomes necessary if the technical parameter of the device under evaluation is at maximum 20% below the lowest or above the highest parameter listed. For this purpose, formula (6) can be applied in a similar way by using the mean original values resp. the technical parameters of the two smallest or the two greatest equipment sizes listed in the table as variables in the formula.

For greater deviations see formula (7) in section 11.5.

In the case of two technical parameters, it is possible to proceed in the same way by taking the limitations imposed in section 11.1 into account.

11.5 Evaluation in special cases (classification in acc. with original value)

If a device cannot be classified or evaluated under existing equipment types (e.g. in cases of new designs) or in case of substantial further developments, the respective original values are to be used as a basis for the evaluation by taking years of use, equipment providing months, depreciation and interest rates as well as repair costs in accordance with the Construction Equipment Register for related or similar equipment types into consideration.

If the original value Ax is to be adapted to the price basis of BGL 2015 – for instance, in such cases where in consortiums (joint ventures) BGL 2015 has been agreed upon as calculation basis – the theoretical mean original value A can be determined on price basis 2014 of BGL 2015 by means of the following formula:

A = Ax * 100 / ix (7)

| A | theoretical mean original value, price basis 2014 |

| Ax | original value in year x (e.g. year of manufacture) |

| ix | producer price index for construction machinery in year x referred to 2014 = 100 (see table 1) |

11.6 Evaluation of discontinued equipment types

In the case of equipment which was listed in BGL 2007, but which is no longer listed in the present edition, the mean original value of the old list can alternatively be converted by means of the producer price index for construction machinery from price basis 2000 to price basis 2014. The factor to be applied for the conversion BGL 2007 / BGL 2015 is 1.246.

12. CONSTRUCTION EQUIPMENT REGISTER and EDP

Since the implementation of the database solution, the requirements of automatic electronic data processing for the construction equipment register has been taken into account not only with regard to the systematic arrangement, but also by indicating the so-called EDP terms in the following way:

- Numbering and labelling of all equipment sizes, equipment options and attachments, including modifications of the standard equipment (increased value, reduced value) with a 10-digit system.

- Predefined short terms for each equipment type, all equipment options and all attachments, which can be stored in EDP systems as short text with max. 20 digits

The EDP terms are shown in capital letters directly under the printed 4-digit designations of the equipment types as well as under the texts of the additional equipment options and attachments.